Today I am smiling. We are done paying for our firstborn’s college!

Today I am smiling. We are done paying for our firstborn’s college!  Wondering how much college costs today? So many anxious parents are. Read on as I’m about to share. I’m also including seven tips on how to cut the cost of the incredibly way-too-expensive college bill that many parents can’t afford.

Wondering how much college costs today? So many anxious parents are. Read on as I’m about to share. I’m also including seven tips on how to cut the cost of the incredibly way-too-expensive college bill that many parents can’t afford.

Today, on this happy day…we just paid…actually we DID NOT pay (more on that in a second) tuition for our son’s FINAL semester of college. Woohoo! I just viewed our total amount paid since he started Arizona State University in the fall of 2016. That number inspired me to write today’s post.

Is anyone reading this trying to guess that grand total? Take your guess and a few paragraphs down you can see how close your answer came. It wasn’t cheap. But it was a heck of a lot less than many we know since our son chose to attend an in-state university.

Many college graduates can’t afford the super high student loan payments that they take with them. Too many students are forced to graduate with a degree in one hand and an expensive student loan payment plan in the other hand.

It isn’t right. I feel for them.

We made out pretty well with our son.

Our daughter is hoping to go out of state, so her situation may be different and may require a different strategy from us. That happens one year from now.

But today we celebrate that my son will graduate in December.

We are DONE paying for his college tuition and overall expenses. Here is what we spent, how we saved and what he did to help with that. Oh…one note…I bet we still have to pay for graduation expenses in a few months. But, for now, here is our damage.

We are DONE paying for his college tuition and overall expenses. Here is what we spent, how we saved and what he did to help with that. Oh…one note…I bet we still have to pay for graduation expenses in a few months. But, for now, here is our damage.

The Final Tally…The Cost For His 3 1/2 years of college

Ready for the final number?

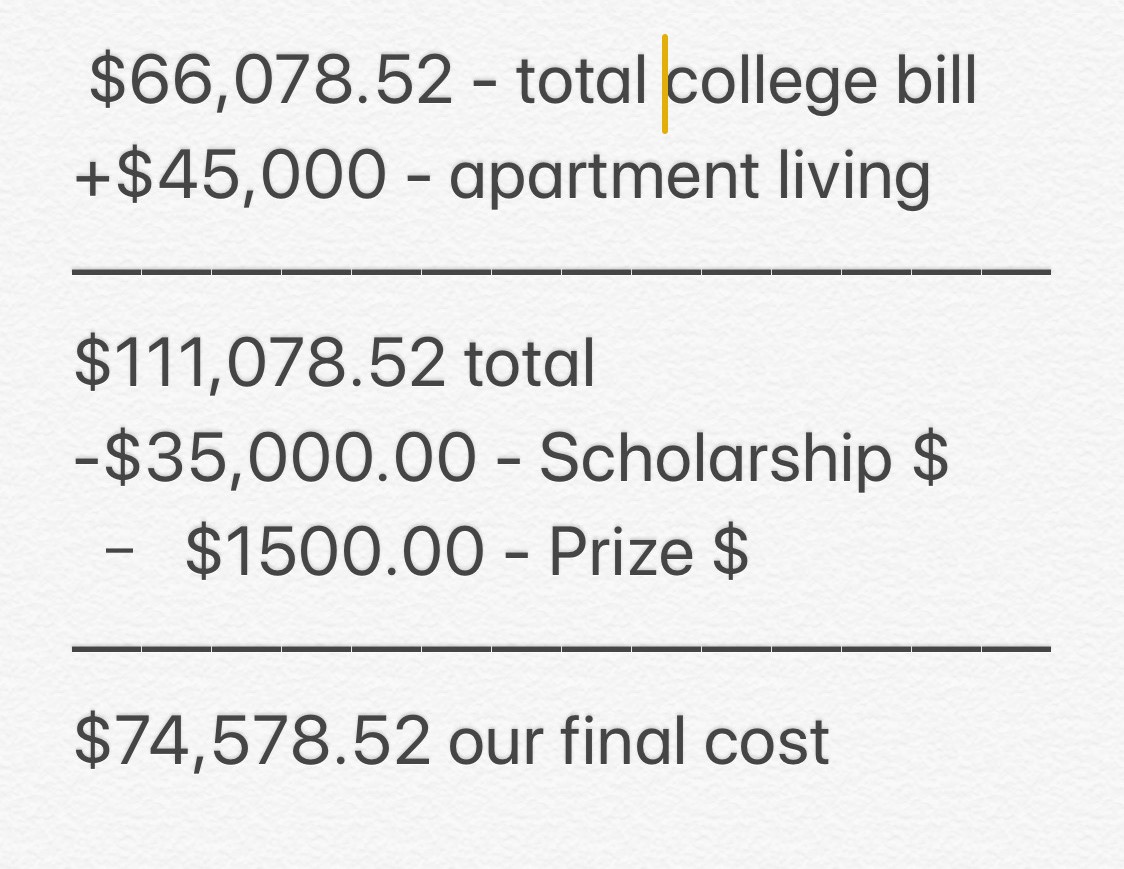

$111,078!! Now before you totally gasp, let me break that number down and explain that we paid a percentage of that out of pocket to give you some hope.

Who guessed close? As you view the number, know that we did NOT actually pay that.

We actually paid $74,578 out of pocket for everything. We paid this over his almost four years of college. The numbers below reflect our son’s FOUR YEARS TOTAL of college costs. The apartment living figure is a bit high because one year our son ended up not having a roommate and we paid more to house him in nice areas of town. That number can definitely be reduced if you are thinking of your own apartment living sitution for your student in the Phoenix area. He is actually completing his education in 3 1/2 years but he took two summers of online courses so that counts as roughly four years. It also reflects dorm costs and post-dorm apartment living, etc. expenses.

Our son started at the ASU Walter Cronkite School of Journalism & Mass Communication in August of 2016. He was additionally enrolled in the ASU Barrett Honors program for the first two years of college as well.

The academic scholarship money he earned, both in high school and later on in college, sure helped as you can see above. Thank you, son!

The numbers above include the dorm/apartment living expenses, meal plan and parking that we paid during his college years. Our son also worked in paying internships, so that reduced the monthly amount we had to give to him for daily expenses and unexpected costs like car repairs, etc.

So that grand total is $111,078.52 for the all-out four years of college in-state at ASU. That includes tuition, room & board, food, parking, books and miscellaneous expenses (there are plenty of those). Plus the Barrett Honors School at ASU was an additional expense as well. Since we had stashed away 529 money, we were mostly covered.

With our college savings plan and our son’s academic scholarship help and the paid internships he worked in all through college…he graduates without student loans. He is very fortunate and he also earned some of this good fortune as well with his hard work.

Yep, $111,000 for an in-state four-year university degree is steep. So be sure to read my savings tips below.

Now compare that to out-of-state annual college costs that average about $80,000 a year. Multiply that by 4 and you get $240,000 versus our $111,000 for our son’s in-state total college costs.

Both numbers are insane, I know!

Here is what our son did, what we did and my tips to cut your personal out of pocket tuition costs. With our daughter enrolling in college next year, she is lucky that we were able to save so much with our son. Read on for these tips!

When I opened my son’s final ASU finance page today, I crossed my fingers that our balance due would say zero. It did say that! The total amount due for tuition this fall semester (does not include living expenses) is $6,194. We owed zero because of two scholarships that he earned. One back in high school and the second just last year in college. So cool. Exact details about each one is below. Take notes and encourage your kids to apply for scholarships and academic competitions.

7 Tips To Save On College Costs!

- Apply for scholarships in high school AND while in college – Our son worked hard in high school making almost all As. He took a lot of honors and AP classes. He scored very high on the ACT with a 32 (that is 98% when he took it in 2015) and in the 90% ranking on the SAT. Taking both the ACT and SAT is the way to go. I highly recommend that. Study hard for these exams. I blogged about several helpful ACT/SAT study apps that my son really liked. See that article here. All of this earned him the New American University Scholar President’s Award which meant that he received $5,000 a semester from start to finish. So that was a $10,000 annual savings which meant $40,000 over the four years of college. He also took dual enrollment courses in high school and summer school in college, so he will finish one semester early. Unfortunately, the $5,000 he would have received this spring disappears. You don’t use it, you lose it. That’s ok as we are super thankful that he will graduate with zero student loan debt.

- Choosing to attend an in-state university – Both my husband and I graduated from The University of Texas at Austin. My degree is in Journalism from UT (my son’s major is Sports Journalism…so cool!) so we would have supported our son’s decision to attend UT or any out-of-state college that had accepted him had he chosen to do so. Lucky for us, he felt instantly at home and motivated the second he entered the Cronkite school at ASU. In state tuition is not cheap, as you saw above, but it is much less than the typical out-of-state all in tuition and fees that average between $50,000 to $70,000 a year. I know…unbelievable!

- Entering in an academic competition IN college – Once enrolled in college, encourage your child to get to know their professors, work hard and ask about competitions that can result in scholarship winnings. Our son placed 2nd in the Hearst Journalism Awards Program. If you clicked to that page, you saw that he received a $2,000 scholarship award. That paid the remaining balance of today’s tuition that was due. With those winnings and the academic $5,000 scholarship dollars that he received from his high school scholarship application, today’s fee…our final one…again was a happy zero dollars! And since he placed 2nd, he attended the national competition in San Francisco last June and took home an additional $2500. Since he will not attend college this spring due to graduating early, he will receive the remaining scholarship dollars from his writing award in a check. He gets to keep that. He earned it.

- Fill out the FAFSA form – I’m not gonna lie. They tell you that the form takes 40 minutes to complete. Not true. Unless the process has been greatly improved since I spent several days gathering all the information that was needed for the FAFSA form in 2016, it is lengthy and it is a bit of work on the part of the parents. But it will determine how much your child can receive in a variety of assistance vehicles that include loans. Make and take the time to do that form! It may even be required now. I will know soon when I have to fill it out for my daughter in a few months.

- Start a college savings vehicle at your child’s birth! We have 529s for both of our kids. We have a fixed amount of money that comes directly out of our checking account and goes into their 529 accounts monthly. It is automatic so it gets invested no matter what. One simple phone call can stop it, increase or decrease the amount. Ask an accountant which college savings plan is the best. I’m not recommending the 529 over any other. That is just what we did, and boy, are we glad we did so.

- Do dual enrollment! Both of our kids did a lot of dual enrollment courses in high school. Some of our friends even have kids who graduated from high school with an associate degree! Dual enrollment is a wonderful way to get some of those tough required courses out of the way before the start of college. It can also really pay off as it has with our son if an early graduation is desired due to incredible internship/job opportunities that can happen during a college student’s senior year. It isn’t cheap, as you will pay a college fee for a college class that can sometimes be as high as $500. However, it saves you in the long run as it did for us. If you are worried that it will be a waste and not transfer to colleges, ask the colleges now which classes may transfer. If your kid is going in state, we have found that they all transfer. We were surprised when we asked some of the California colleges that my daughter is interested in about dual enrollment credits. More than we expected will transfer, we are told. We will see. Crossing our fingers that is true. I will keep you posted. For our son it paid off very well.

- Consider community college first – With the ridiculous cost of college today, many families choose this option. Back in 1985, I did this. I attended Austin Community College for my first two years. I worked, obtained my in-state residency and earned an academic scholarship upon admittance to UT Austin. It was a win win win! My daughter is applying to a lot of big out-of-state universities but our family agrees that she may end up starting at a community college, as I did, for the same reasons that I did it.

So, there you have it! That explains why we are celebrating today. Last semester paid off today. With zero money owed. Our firstborn’s college is paid off in full!  No loans. Scholarships that he worked for. And I shared with you that total cost. Not cheap. Not at all.

No loans. Scholarships that he worked for. And I shared with you that total cost. Not cheap. Not at all.

Consider the seven tips I shared. Start early. Think about all of this now. You won’t believe how fast your little baby becomes a big college freshman. Enjoy the ride and work with your kid to make it more affordable.

Good luck. Wish us luck as well. As we celebrate today, we strap in to do it all over again with our girl!